What They Don’t Tell You About Investment Content Automation

Investment content automation is supposed to simplify your life. You buy a platform to streamline factsheets, pitchbooks, or client reports—only to end up managing sync issues, reworking stale data, and limping your way through every variation.

This isn’t a user problem. It’s an architecture problem.

Here’s what most vendors won’t tell you—and what Assette does differently.

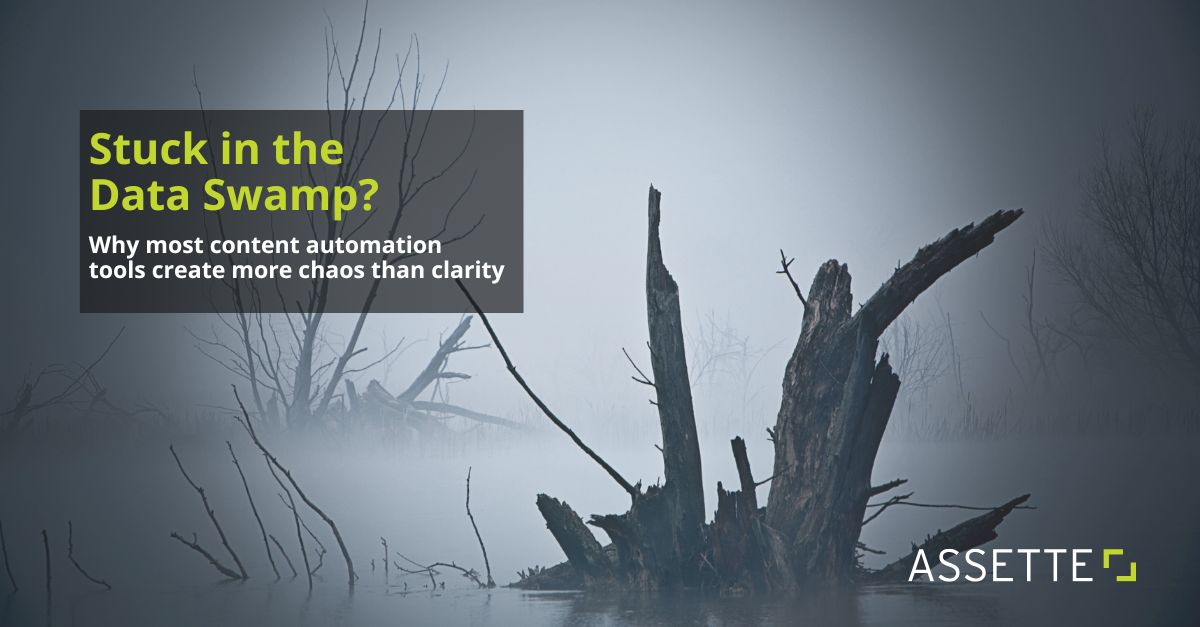

The Hidden Cost of the Data Swamp

A data swamp happens when your data is technically available—but practically useless. It’s stale, duplicated, or disconnected from actual workflows.

Amazingly, this is still how many “automated” content platforms operate.

They ask you to:

- Warehouse your data

- Duplicate it into their system

- Hope it stays in sync

- Wonder why it doesn’t

That’s not integration. That’s fragility masquerading as automation.

At Assette, we do the opposite: We stream clean, validated data directly from your source systems into your deliverables—live, traceable, and duplication-free.

Why Most Platforms Don’t Support Real Investment Content Automation

You’d think streaming data into content would be the default. It’s not.

Here’s why:

- They weren’t built for it. Many evolved from sales enablement tools, where content—not data—was the core.

- They don’t trust live data. Without logic layers, they force teams to “freeze” data upstream to make it safe.

- True pass-through requires engineering. Flexible models, template logic, guarantees—most vendors just can’t deliver.

- Lock-in is by design. When your data lives in their system, switching becomes harder. Syncing becomes your problem.

Assette was purpose-built to stream data into investment content. We transform data mid-flight and output it into structured, scalable templates.

Generic Platforms Weren’t Built for Investment Content

Most content tools prioritize wide creative flexibility and visual assets. That makes sense—for tech, SaaS, or consulting. But it breaks down fast for investment marketing.

You’ve seen the symptoms:

- Dense performance data crammed into slideware

- Manual disclaimers in design tools with no audit trail

- Templates reinvented to fit rigid layouts

- Stitched-together workarounds that feel like duct tape

Assette is different. From the pipeline to the PowerPoint, our system was designed for factsheets, pitchbooks, client reports, and disclosure-heavy content in investment management.

The “Sync Job” Red Flag

“Don’t worry—we sync your data nightly!”

If you hear that, worry.

Sync jobs are:

- Asynchronous

- Error-prone

- Opaque

- Dependent on brittle ETL logic

If a number changes mid-cycle—or if the sync silently fails—your content is already outdated.

With Assette, there’s nothing to sync. We never duplicate your data in the first place. Instead, content pulls from live streams, with full traceability.

The Adminless Platform Myth

“No IT required!” is a common pitch. Until you need to:

- Add a new metric

- Change a chart layout

- Update disclaimer logic

Suddenly, you need scripts, vendor hours, or a dedicated admin.

Assette puts control in the hands of marketers and client reporting teams.

Templates are governed but flexible. Logic and layout are accessible. You stay in control—no middlemen needed.

What Clean, Scalable Investment Content Automation Looks Like

You shouldn’t have to choose between:

- Automation and polish

- Speed and compliance

- Scale and sanity

With Assette, you don’t.

Here’s What it Looks Like

- Live data streaming (no sync jobs)

- Dynamic, reusable templates (no hardcoding)

- Built-in auditability (not bolted-on)

- Consistent output across all content types

This is what real investment content automation looks like.

You Don’t Have to Settle

Too many investment teams are duct-taping their way through quarter-end.

Too many platforms promise automation—but deliver complexity.

There’s a better way.

It’s purpose-built.

It’s Assette.

From Chaos to Control in 90 Days

A $120B AUM firm fixed their factsheet process in just 90 days—eliminating IT bottlenecks, version confusion, and compliance slowdowns. They doubled output without adding headcount, and now generate factsheets in hours, not weeks.

Industry Insight: Alpha FMC’s “Content Imperative” report reinforces this shift: investment firms that fail to modernize content delivery risk falling behind both client expectations and operational benchmarks.